Managing payrolls is one of the most critical and is often the most complex tasks in businesses. Not to mention that the smallest of mistakes in this area can cost you very dearly. QuickBooks managed payroll services stand out as the best for small and medium-sized businesses due to its wide variety of features and the ability to automate the most complex of tasks. In this blog post, we will tell you about the QuickBooks payroll cloud services and how it can assist your business growth.

The QuickBooks payroll cloud solutions offer a wide array of benefits for businesses with unique needs and concerns. However, if you are unsure about it or have questions, then connect with our experts at +1(800) 217-0394 for quick solutions.

How Does The QuickBooks Payroll Work?

In order to start the QuickBooks payroll services, you will first need to select a plan. Thankfully, QuickBooks offers a variety of licensing options to cater to the unique needs and concerns of businesses. Once you have found a plan that best suits your business, you can start this service to pay employees, manage taxes, and for various other tasks. The best part? You will be able to do all this from one place.

Mentioned below is a simple breakdown of how the QuickBooks manage payroll cloud services work.

1. Fill Details

To start the service, you will first need to enter some details, such as company information, employees’ data, etc. The QuickBooks payroll will walk you throughout this step, so you don’t need to worry about investing in an IT service.

2. Run Payroll

Once you have entered the data, you can easily run the payroll. However, you will need to configure some features, bonuses, and deductions in the salaries.

3. File and Pay Payroll Taxes

With the QuickBooks payroll on cloud at your side, you don’t need to worry about manually calculating, filing, and paying payroll taxes, as the software will do these tasks for you. Through this, you can ensure that there are no human errors and can make effective progress towards the betterment of your business.

What Is The System Requirement For QuickBooks Cloud Payroll Services?

Although the QuickBooks cloud payroll can help to easily automate tasks, it has a few system requirements in order to smoothly work. These requirements include:

A Stable Internet Connection: Whether you are accessing the QuickBooks payroll software from the cloud or from the desktop version, a stable internet connection is required to get a smooth experience. If you are on a poor network, then the software is likely to stutter.

Browser Compatibility: If you want to experience the best result of this service, then we recommend that you use one of the mentioned below browser.

- Google Chrome (version 78 or newer)

- Microsoft Edge (version 79 or newer)

- Mozilla Firefox (version 76 or newer)

- Opera Browser (version 68 or newer)

- Safari (version 12 or newer)

- Samsung Internet (version 10 or newer)

Benefits of The QuickBooks Payroll Cloud Services

In addition to helping automate payroll, you will also be able to experience a multitude of other benefits with this service.

- Save Time and Efforts: The main benefit of the cloud based QuickBooks payroll services is that you will be able to easily automate employee payroll without any issues. This will help to save both time and effort while reducing the chances of human-made errors.

- Accurate Real-Time Reports: Manual payroll entries can be a tedious task and not to mention the number of errors it can cause. QuickBooks payroll on cloud provides a solution to this as it allows to easily track data in real-time. With this tracking system, you can prevent a number of errors coming to life, such as lost time cards, failure to track overtime, and missed clock-outs.

- Security: With the QuickBooks cloud payroll services, you don’t need to worry about the safety and security of your data. The cloud software follows the highest standards of security protocols and uses the AES256 encryption. Moreover, this encryption is backed by a 256-bit key while a firewall ensures the safety of the servers.

What Are The Features of QuickBooks Payroll?

Mentioned below are the features of QuickBooks payroll.

Unlimited Payroll Runs

QuickBooks payroll cloud services do not impose any kind of restrictions as to how many payrolls can be sent. Due to there being unlimited payroll runs, you don’t need to purchase any additional license, nor will you be charged for any additional runs. This makes the payroll services of QuickBooks ideal for businesses that want to automate this task without making huge investments or worrying about running into errors.

Payroll Automation

The software allows you to easily automate payroll without requiring you to manually add entries or review each file. However, do note that you will need to create a new entry if you have already processed a payroll but later realised that there are changes.

Direct Deposits

With QuickBooks payroll cloud services, you can easily and directly deposit paychecks electronically to the employee’s bank. This is a fast and secure way, and it helps employers to pay their employees on time.

Issues To Look Out For In QuickBooks Payroll Services

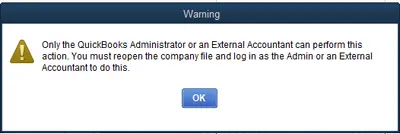

While the payroll service offers a multitude of benefits, you will need to look out for a few issues. If you are accessing the service as a user, then you may see the only Administrator or External accountant can perform this action error message. Although this error message does not provide any kind of information to help understand its cause, the reason can be rooted in either the host ending the session or your invitation expiring. In either case, you will need to connect with the host and request permissions for an administrator for the QuickBooks cloud payroll for accountants.

To Conclude

The QuickBooks payroll cloud services provide an easy, effective, and most importantly, reliable solution to automate employee payroll. Due to the software using high-quality security protocols, your data stays safe and secure at all times. Furthermore, the software is easy to setup, allows for remote access, and provides the ability to track data in real-time.

In case you have any questions or need assistance with the QuickBooks payroll cloud services, then don’t hesitate to connect with our team of experts at +1(800) 217-0394.

Can I setup the QuickBooks cloud payroll software myself?

Yes, you can set this software up by yourself. Moreover, a guide for the process is also included to help you throughout the steps.

Can QuickBooks payroll cloud help me file taxes?

Yes, you can file taxes electronically via the QuickBooks payroll cloud services.

Does the QuickBooks cloud payroll allow for direct deposits?

Absolutely, the QuickBooks payroll cloud solutions allow you to directly deposit paychecks into your employees’ bank accounts.

Why can I not log into QuickBooks payroll cloud services?

If you are not able to log into your payroll cloud services of QuickBooks, then it is possible that your internet is acting up or an update has come. You can fix it by shifting to a stable network or updating the software.

How do I fix payroll cloud services quickbooks desktop not working?

To address this issue, you can start by first checking your internet connection, clearing cache, enabling cookies. In case the error is still there, then it may be possible that the host has ended the session or your invitation has expired. In either case, you will need to ask the host to send you an invite again.

Brown Lopez is a Cloud Engineer and technical writer based in Austin, USA, who enjoys turning complex cloud ideas into clear, simple insights. With solid experience in cloud architecture and real-world projects, he loves creating practical content that helps professionals understand, build, and improve their cloud solutions with confidence.