Do you know why fintech choosing a cloud services provider? Well, cloud computing is becoming an important decision for most companies as it saves time, money, and effort.

As the stats says- the global market size of cloud computing was estimated at USD 752.44 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 20.4% from 2025 to 2030.

Hence, the growth of cloud computing in fintech industry has already changed the way many startups and financial companies are working. With the help of cloud computing and its scalable solutions, these businesses can improve their services.

Cloud computing is now enabling the companies to keep and process the data on faraway computers with the help of good internet connection. With this, fintech sector is getting multiple opportunities that helps them to innovate and grow.

Additionally, top cloud service providers in USA are playing a crucial role in offering secure and scalable infrastructure to support this transformation

This blog will help you figure out the key reasons why fintech choosing a cloud services provider.

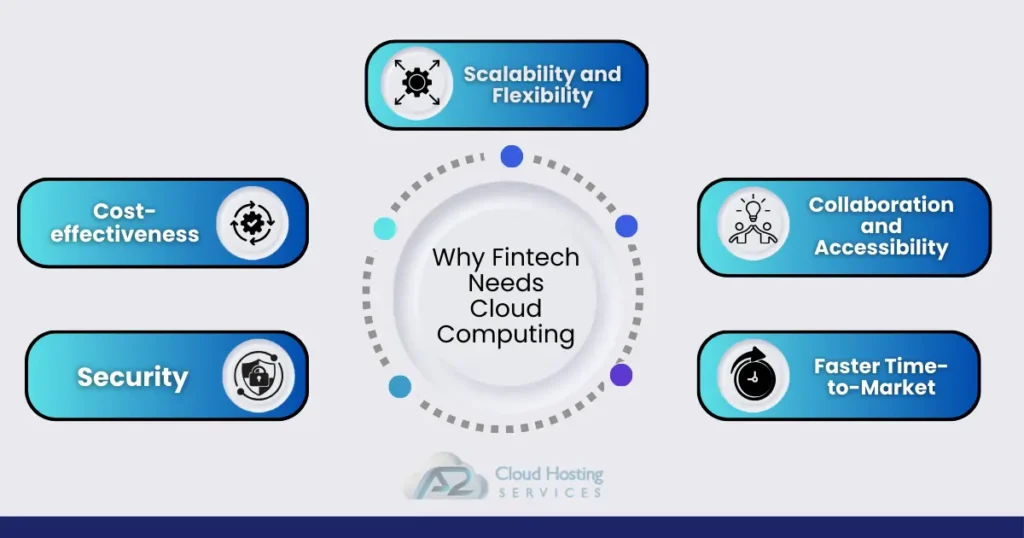

Why Cloud Services Are Important for Fintech – Key Points

Since fintech businesses are at the front of technology advancement, they need flexible, safe, and affordable solutions.

Here’s the key points organized into a simple chart to help industries like medical, real estate, and Fintech choosing cloud services provider smartly.

| Key Points | Details |

| Scalability and Flexibility | Easily scale up or down based on demand. – Flexibility to manage peak hours or business expansion. – No need for expensive infrastructure upgrades. |

| Cost-effectiveness | Reduces need for large upfront investments in hardware and software. – Pay only for the resources used. – Lower ongoing maintenance costs compared to traditional IT systems. |

| Security | High-security features like encryption and firewalls. – Frequent data backups for protection. – Cloud providers offer security maintenance teams to meet legal requirements. |

| Innovation and Flexibility | Enables rapid innovation and product development. – Access to the latest cloud-native technologies. – Helps fintech companies stay ahead of the competition. |

| Data Analytics & AI Integration | Cloud platforms provide tools for big data analytics and AI/ML, helping fintech firms offer personalized services and detect fraud in real time. |

READ MORE: What is Cloud Hosting?

How Cloud Computing is Powering the Fintech Revolution

Imagine, you used to have to go to a bank branch for everything, right? Now, your phone can be your bank, your investment advisor, and even your loan officer. That’s largely because of the cloud. Think of it as this massive, flexible digital space where fintech companies can build and run their services. It’s not just about storage; it’s about making things smarter and faster.

This will help you understand why fintech choosing a cloud services provider. Here’s a breakdown the benefits of cloud computing in the fintech industry:

1. Personalization, Now a Reality:

Remember those generic financial products? Gone are the days. Now, fintech companies use the cloud to really get to know you. They analyze your spending habits, your financial goals, and tailor everything to fit your life. It’s like having a financial advisor who actually understands you, without the formalities.

2. Innovation:

Think of the cloud as a giant playground for innovation. Things like blockchain and AI, which used to be super expensive and complicated, are now much more accessible. Fintech, choosing cloud service provider can experiment, test new ideas, and launch groundbreaking services without breaking the bank. It’s like giving them the tools to build the future of finance.

3. Working Together, Seamlessly:

The financial world used to be pretty siloed. Banks, insurance companies, payment processors – everyone kept to themselves. The cloud has changed that. Now, they can all connect and share information securely. This means smoother, more integrated services for you. Imagine, getting a loan, insurance, and investment advice all in one place, without having to jump through hoops.

4. Real-Time Insights, Real-Time Decisions:

Data is the new gold, and the cloud is the mine. Fintech companies, choosing cloud service provider, can now process huge amounts of data in real time, which means they can spot trends, identify risks, and make smarter decisions much faster. This translates to better products, lower fees, and a more secure financial experience for you.

Read More: What is Virtual Desktop Infrastructure (VDI)?

The Importance of Reliable Cloud Services for Fintech Businesses

For fintech businesses, proper cloud service selection is critical to guarantee scale, security, and dependability. Rising consumer expectations call for flexible cloud infrastructure to manage ever-increasing transaction and data volumes.

Particularly in the financial sector, where sensitive data have to be safeguarded, security and compliance are absolutely vital. To cut downtime and optimize resources, a trustworthy supplier ought to provide expert support, cost effectiveness, and high availability.

A2 Cloud Hosting offers adjustable, safe cloud solutions designed particularly for fintech companies, guaranteeing continuous operations and around-the-clock support for prospects.

Find More: The Evolving Landscape of Cloud Accounting Security

What A2 Cloud Hosting Services Bring to Your Fintech Business

Fintech organizations might consider A2 Cloud Hosting for the following reasons:

Here’s the information organized into a simple chart that helps you understand why fintech choosing a cloud services provider

| Aspect | Details |

| Fintech Customizable Solutions | – Tailored cloud-based solutions for the fintech sector. – Solutions designed to meet the unique needs of both established companies and startups. |

| High-Performance Architecture | – Fast and efficient cloud architecture for finance apps. – Quick load speeds and reliable uptime, ensuring 24/7 availability. |

| Advanced Security Features | – Strong security measures, including SSL encryption and DDoS protection. – Regular security audits to ensure data protection. – Ideal for safeguarding private financial information. |

| Scalability for Growth | – Easily scale infrastructure as your fintech company grows. – Flexible cloud hosting options to meet increased storage, processing, or bandwidth needs. |

READ MORE: Benefits of Using Cloud Storage.

Conclusion

Certainly, revolutionizing the fintech sector is cloud computing, it provides secure scalable, economical alternatives remaking financial services. Adoption of cloud technology by fintech businesses opens up fast innovation, customized services and smooth incorporation of many financial products.

As, Cloud computing will remain at the heart of driving creativity, improving consumer experience, and meeting the rising demands of the industry as fintech evolves.

Hopefully, with the above given information, This will help you surmise why fintech choosing a cloud services provider. Contact us at +1(800) 217-0394 and talk with our cloud expert for personalized guidance and the best cloud hosting solutions for your new or established business.

Frequently Asked Questions

How is cloud computing used in finance?

In the financial industry, cloud computing enables businesses to store and process data remotely, facilitating safe transactions, real-time analytics, and affordable scalability. That’s why many industries like IT, Medical, and Fintech choosing a cloud services provider for better accessibility.

How can financial firms ensure a smooth cloud migration?

Through careful planning, system testing, compliance assurance, and collaboration with seasoned cloud providers, financial institutions may guarantee a seamless cloud migration.

Why are banks moving to the cloud?

In order to increase operational effectiveness, save expenses, improve security, and provide better client experiences, banks are migrating to the cloud.

What are the cost benefits of cloud computing in finance?

Long-term savings come from cloud computing’s ability to lower upfront equipment costs, provide flexible pricing, and do away with the need for intensive IT maintenance.

How Cloud Adoption in Financial Services Affects the Industry?

Adoption of cloud computing in financial services boosts operational agility, fosters innovation, and improves customer service while improving data security and compliance.

Brown Lopez is a Cloud Engineer and technical writer based in Austin, USA, who enjoys turning complex cloud ideas into clear, simple insights. With solid experience in cloud architecture and real-world projects, he loves creating practical content that helps professionals understand, build, and improve their cloud solutions with confidence.